Prepare now for a period of lower interest rates

The extreme volatility in the global economy and financial markets over the past few years are a stark reminder that uncertainty lurks around every corner. Global stock markets have see-sawed from extreme highs to record lows over the past few years, leaving ordinary investors unsure of what to expect.

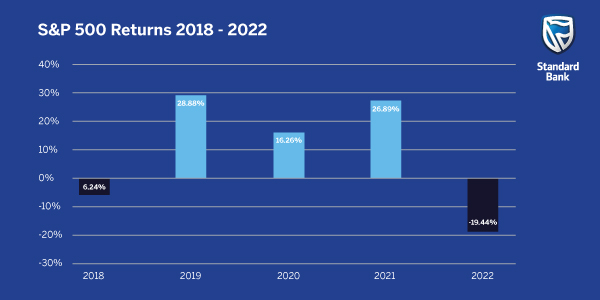

For instance, the S&P 500 index that includes the 500 largest companies listed in the United States has seen particularly wild swings prior to and since the COVID pandemic.

This graph shows the calendar-year returns of the S&P 500 index, although 2020’s full-year return belies the panic in the markets early in the year when the coronavirus started spreading at alarming pace.

In early March of that year, the Dow Jones Industrial Average lost as much as 37% of its value, while the S&P 500 lost 34%. Other global indices also suffered double-digit percentage declines.

On the whole, your returns over this period would be positive, but not without some bumpy rides in between.

A key lesson has been that you cannot take the future for granted, and that you need to spread your risks wisely for the best chance of meeting your long-term financial goals. One of the objectives with this type of diversification is the hope that one class appreciates in value when others depreciate.

The art of threat management

In the past few years, savers have enjoyed an unexpected boon from higher returns as account interest rates have risen in tandem with inflation. So, for little or no risk your capital would have appreciated faster than pre-Covid when rates were at historically low levels.

However, this picture is about to change.

“From a macro-economic perspective the market is expecting interest rates to fall over the next five years meaning people will earn less on their savings,” says Chris Berry, Head of Structured Products at Standard Bank . “Accompanying this is an expected shift in the allocation of savings once cash is a less attractive alternative. People will look for other homes for their investments, with equities being a natural one that can push up prices.”

So, your savings will deliver lower returns in the future if inflation and interest rates continue to fall as expected.

Suddenly, the threat that you need to guard against inflation is that your savings aren’t delivering appealing returns as rates decline.

Plan now for the future

Financially astute investors understand that decisions made today are based on the expectation of conditions in the future. And while the future is undeniably uncertain, the expectation that rates will fall must be considered in decisions you’re making now.

That means looking for solutions that either lock in the current rates for a long period, or that aim to capitalise on the change to a lower inflation, higher growth world.

Your financial plan will dictate the extent to which you need to pivot your portfolio from dependable but low-growth products into growth assets such as equities. Finding the right balance between growth and dependability is a constant battle that you probably know all too well.

One worthwhile solution that straddles these competing interests is a Structured Product. The make-up of these products differs from provider to provider, with Standard Bank issuing capital-protected* products on a regular basis.

These solutions have a defined start and end date that typically span four or more years.

What sets each of our Structured Products apart is that they are designed to take advantage of specific trends and expected market outcomes. This means that much of the guess work has been done for you by our investment managers who are experts at optimising funds and structures to produce specific results.

Index-tracking deposits

For instance, your returns in our ESG Index Linked Deposit Issue 6 are based on the performance of the S&P 500 ESG Index. Your five-year fixed deposit will be active between January 2024 and January 2029.

ESG investing is a popular theme at the moment and is based on the premise that companies with clean Environmental, Social and Governance (ESG) records are more likely to produce better returns.

Companies with strong ESG credentials also appeal to people who want to invest with a clean conscience. Companies that produce controversial weapons or tobacco, for example, are not included in the list of ESG-compliant companies because of the harmful effects of their products on society.

At the end of the five-year term, you will receive back your deposit plus any market-linked return, which is 75% of the market performance.

An alternative to the ESG theme is our Quantum Plus 33 Deposit, which also runs from January 2024 to January 2029. The returns offered by this product are based on the performance of low-volatility indices, placing this product in the low to moderate risk category.

You’re offered the best of both worlds with this option because you will receive back your deposit plus the Quantum portion (40% of your deposit) earns a fixed rate that is determined by your deposit currency – GBP, USD or AUD. The remainder of your deposit is linked to the market performance over the five year term.

Once again, your deposit currency determines which market it tracks. GBP deposits are linked to the S&P Europe 350 Low Volatility Index, USD deposits are linked to the S&P 500 Low Volatility Index, and AUD deposits are linked to the S&P/ASX 200 Index.

If you’re a nervous investor who is easily spooked by market turmoil, then the fixed term nature of these structured products could play in your favour. Waiting out the five-year period is encouraged through early withdrawal fees, but because your initial deposit will be returned irrespective of what the market does, there’s no need to panic and withdraw your funds early. **.

As with any financial product or decision, it pays to familiarise yourself with the specifics of these structured products. You can read more about our two upcoming Structured Products here, which includes detailed product brochures.

* Capital protection refers to the Product’s design to repay your original Sterling, US dollar or Australian dollar deposit in full providing you retain your deposit until the relevant Maturity Date.

** Where a structured deposit’s return at the end of its term is zero, the depositor’s real rate of return may be negative