Setting up your international investment portfolio

Invest internationally and diversify your portfolio

Are you a parent who would like your child to study overseas? Or are you learning more about financial fitness and how having a diverse portfolio will keep your money safe, allowing you to feel confident no matter your own country’s socio-political circumstances?

A global investment portfolio opens doors to reaching your dreams, empowering you to save and invest towards goals, such as retirement, your children’s education or even a passive income. Since Standard Bank Offshore is based on the Isle of Man and Jersey, we assure you the security and peace of mind that your money is in safe hands in a well-regulated jurisdiction, with access to major international currencies.

How does it work?

You may have found the jargon surrounding international banking confusing, but for those looking to broaden their horizons, offshore banking with Standard Bank Offshore is a safe and reliable option, providing you with access to opportunities without complex finance speak.

International investment is right for you if you:

- are looking for financial security, expertise and fluidity,

- want to invest in hard currencies that can be more stable during global change or

- want a diverse portfolio and access to global markets.

It doesn’t have to be complicated. The process of moving your funds out of a bank within your borders is easy. We have options for every situation and need. Standard Bank Offshore can assure security and stability of your deposit, a welcome bulwark against a volatile home currency.

Our international investment options and how they work

Short-term investment: Structured products and structured notes

Are you looking for a lower-risk global investment option? We make it easy with structured products and structured notes. Structured products and notes are designed to be easily understood and accessed while protecting your money.

Structured products( structured deposits) offer capital-protected deposits linked to an equity index, protecting your deposit if the market falls at the end of the term. However, if there is a positive return, structured products pay out a percentage (at times, above 100%) of the index growth at maturity.

Structured notes are investment products designed for more experienced investors, requiring a higher minimum investment amount than structured products. The terms range from 1 to 5 years and can be linked to both an equity index or interest rates, depending on your needs.

What you’ll get

- A capital-protected investment product that’s linked to an equity index or interest rates

- Growth that can potentially keep up with inflation and is paid out either during or at the end of your investment term

- Simplicity: No additional charges or admin from your side

- A bespoke solution tailored to your needs

- Transparency: All associated risks and costs are fully explained before you make an investment decision

Note: To access structured products and structured notes, you need to have a Standard Bank Offshore International Bank Account. The process of setting one up can be done from anywhere in the world.

Personalised investment: Discretionary services

With our discretionary services, you can partner with a team that understands your investment objectives and has the skills and expertise to make decisions on your behalf so that you can capture those opportunities.

Discretionary portfolio services link you to a team of investment managers that can help you best capture opportunities within the global investment environment.

What you’ll get

- 5 risk-weighted portfolio strategies and solutions created with your needs in mind

- A dedicated portfolio manager, wealth manager and wealth advisor

- Regular updates and portfolio valuations

- 24/7 access to view your investments online

- Regular updates on your portfolio strategy

- Global custody facilities

- Investment holding statements and consolidated tax vouchers

- Capital and income segregation

When considering discretionary services, you should be prepared to invest for at least 5 years. Our team of discretionary investment professionals manage your investment on your behalf in partnership with you, which means they are on hand to talk through their approach and strategy. Solutions are tailored to your needs and designed to be actively managed towards your objective.

Note: Returns on this type of investment are not guaranteed, and you may get back less than you invest.

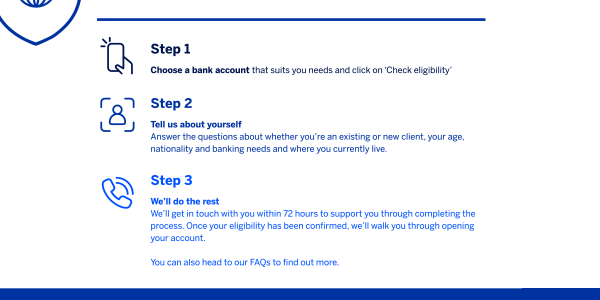

Compare our bank accounts and check your eligibility and let your dreams go global.

Open an account with Standard Bank and start using our Banking services.